Brazilian government changes IOF rules

In brief

As of May 23, 2025, Decree No. 12.466, of May 22, 2025, which amends Decree No. 6.306, of December 14, 2007, the Regulation of the Tax on Credit, Exchange and Insurance Transactions – IOF, came into force.

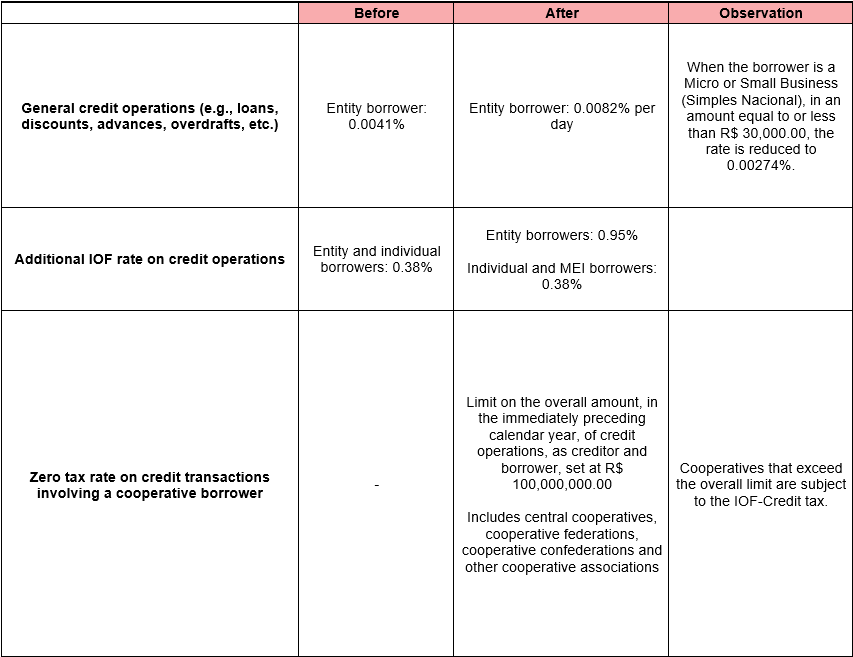

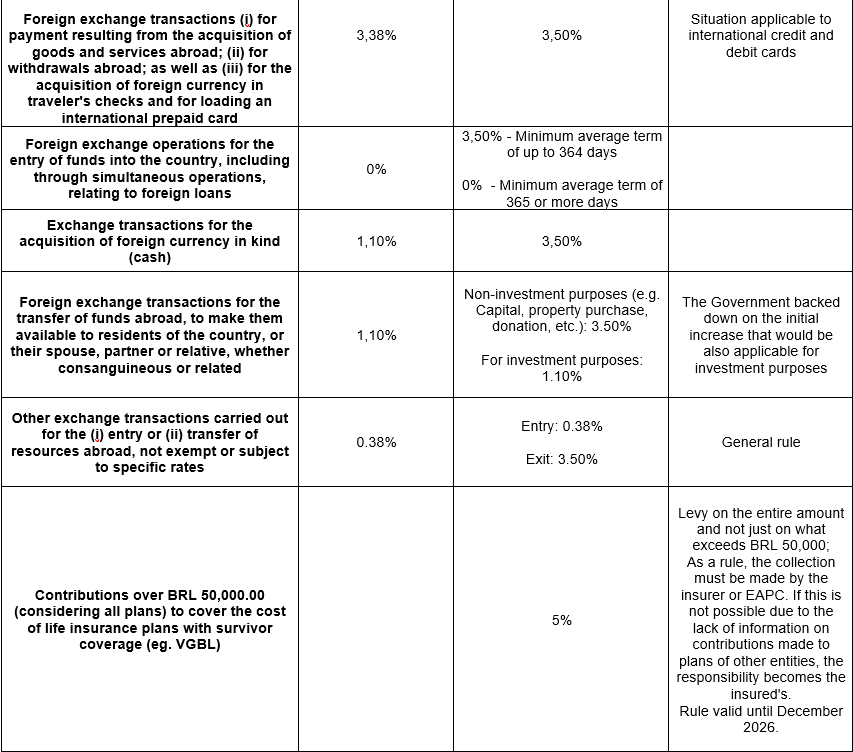

The changes provide for an increase in tax rates on various transactions, summarized in the table below.

In more detail

In the following day, via the new Decree No. 12.467, the Federal Government backed down from increasing the rates on foreign exchange transactions, transfers to and from abroad, relating to investment funds in the international market, maintaining the zero rate previously in force.

The new rates are effective immediately, without the application of any rule of anteriority.

These new IOF rates run counter to the previously stated objective of aligning with OECD standards, as prior to these changes there was a scheduled gradual reduction of the IOF rates to 0% by 2029. Nonetheless, dividends and interest on net equity (JCP) distributed to foreign shareholders by Brazilian companies remain subject to a zero IOF rate.

We are available to help you understand in detail the impacts and alternatives applicable to the points addressed in this alert. Please contact one of our team members.

This newsletter is only a general review of the subjects covered and does not constitute a legal opinion or consultation.