Brazil: New Opportunity to Settle Tax Debts in the State of São Paulo: Special Program for Overdue Liability Certificates

In brief

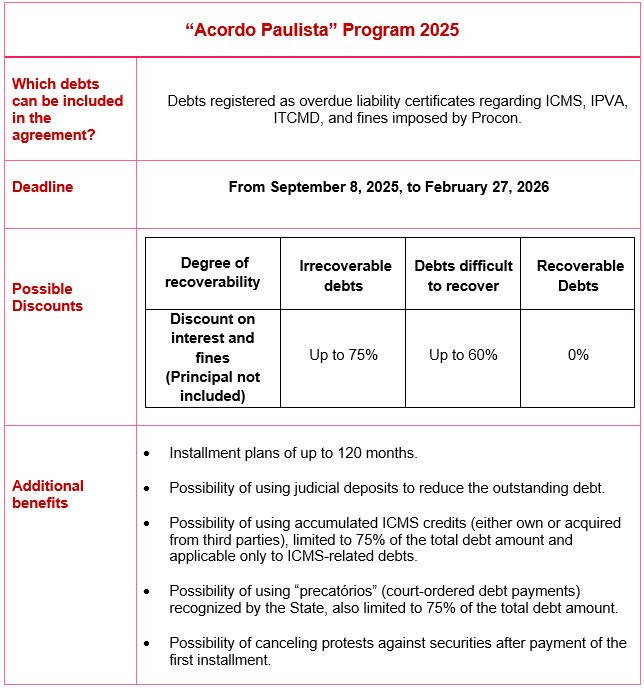

On September 8, 2025, Notice PGE/TR No. 1/2025 was published, establishing the Special Settlement Program in the State of Sao Paulo (Known as “Programa Acordo Paulista”). This program aims to facilitate the regularization of debts related to ICMS (VAT), ITCMD (Tax on Transmission of Property Causa Mortis and Donations), IPVA (Tax on Motor Vehicles), and fines imposed by Procon (The Department for Consumer Protection and Defense).

These debts must be registered as overdue liability certificates at the State Treasury in São Paulo.

The program offers favorable conditions, including discounts on interest and fines (except for debts classified as recoverable, which are not eligible for discounts), payment in up to 120 installments, and alternative options for settling debts, such as the use of VAT credits.

The deadline for joining is from September 8, 2025, to February 27, 2026.

In more detail

The main features of the Notice are as follows:

We remain at your disposal to clarify any doubts you may have.