Federal Treasury and IRS are in charge of the second phase of the PTI-PRJ (judicialized credit collection transaction)

In brief

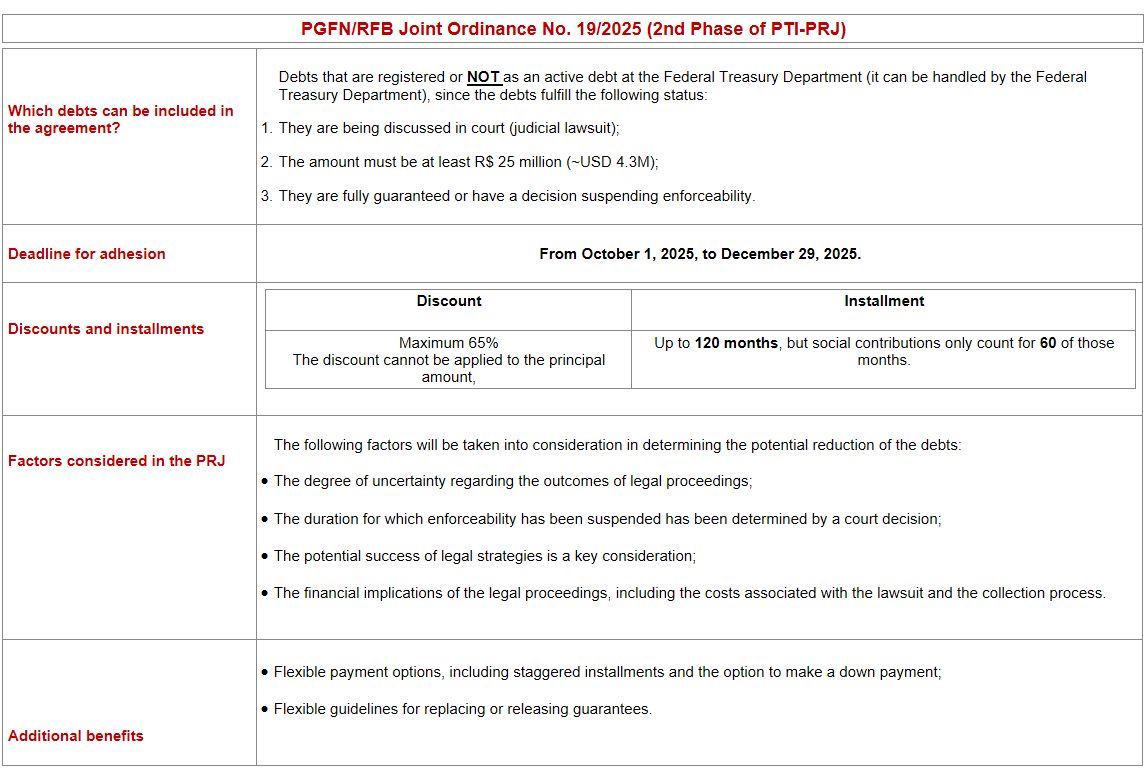

On September 30, 2025, PGFN/RFB Joint Ordinance No. 19/2025 was published. This ordinance deals with the second phase of the transaction in the collection of judicialized credits of high economic impact. These credits are based on the Reasonable Recovery Potential of the Judicialized Credit (PRJ) of the Comprehensive Transaction Program (PTI). This PTI was established by MF Normative Ordinance No. 1,383, of August 29, 2024.

The new regulation has the following features:

- The agreement now covers debts starting at R$25 million (~USD 4.3M), lowered from the previous R$50 million minimum in phase one.

- Registration of debts as active debt by the Federal Government is not obligatory; such debts may alternatively be registered with the Federal Revenue Service.

The application period for the program is from: October 1, 2025, to December 29, 2025.

In more detail

The main features of the Ordinance are as follows: