PGFN and IRS publish Notice PGFN/RFB 51/2025 with New Opportunities for Tax Settlement

In brief

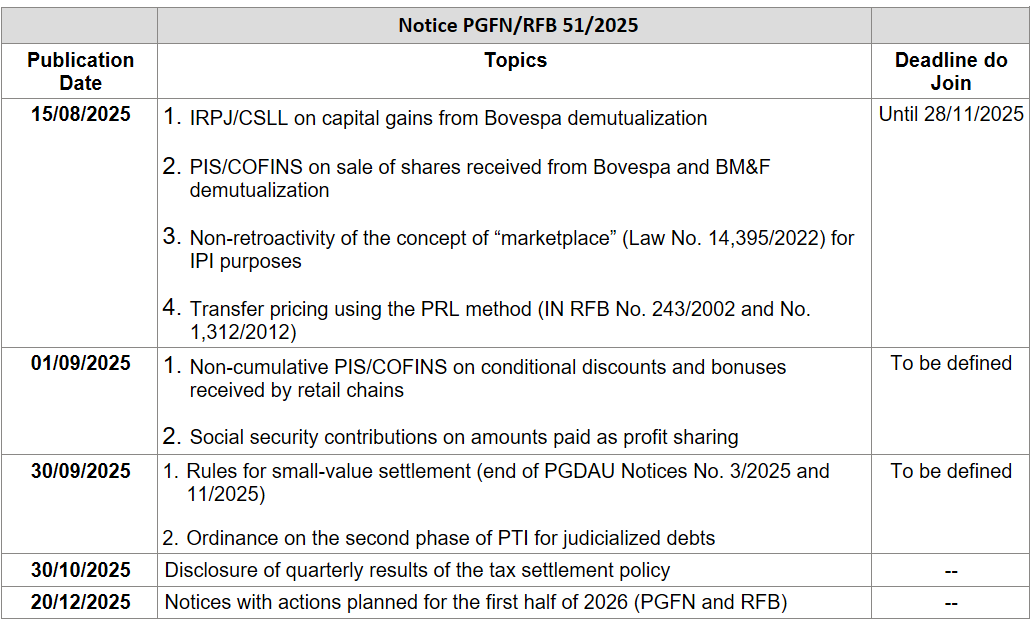

On August 15, 2025, the PGFN and the Brazilian Federal Revenue Service (RFB) published Notice No. 51/2025, establishing the action calendar for the second half of 2025 under the tax settlement program. This initiative is part of the Comprehensive Settlement Program (PTI), created by Normative Ordinance MF No. 1,383/2024.

The notice addresses highly relevant and legally controversial tax matters, offering special negotiation conditions and defined deadlines for adherence.

In more detail

Tax settlement notices aimed at resolving legal theses typically offer favorable conditions, such as discounts of up to 65% on the total amount of credits, and the possibility of using NOLs, as well as precatórios (court-ordered payments) to offset debts. Exact conditions, including eligibility criteria and payment methods, will depend on the publication of specific notices for each thesis.