Provisional Measure establishes new rules for the taxation of financial investments and virtual assets and Decree adjusts the increase of the IOF

In brief

On June 11, Provisional Measure No. 1,303/2025 and Decree No. 12,499/2025 were published.

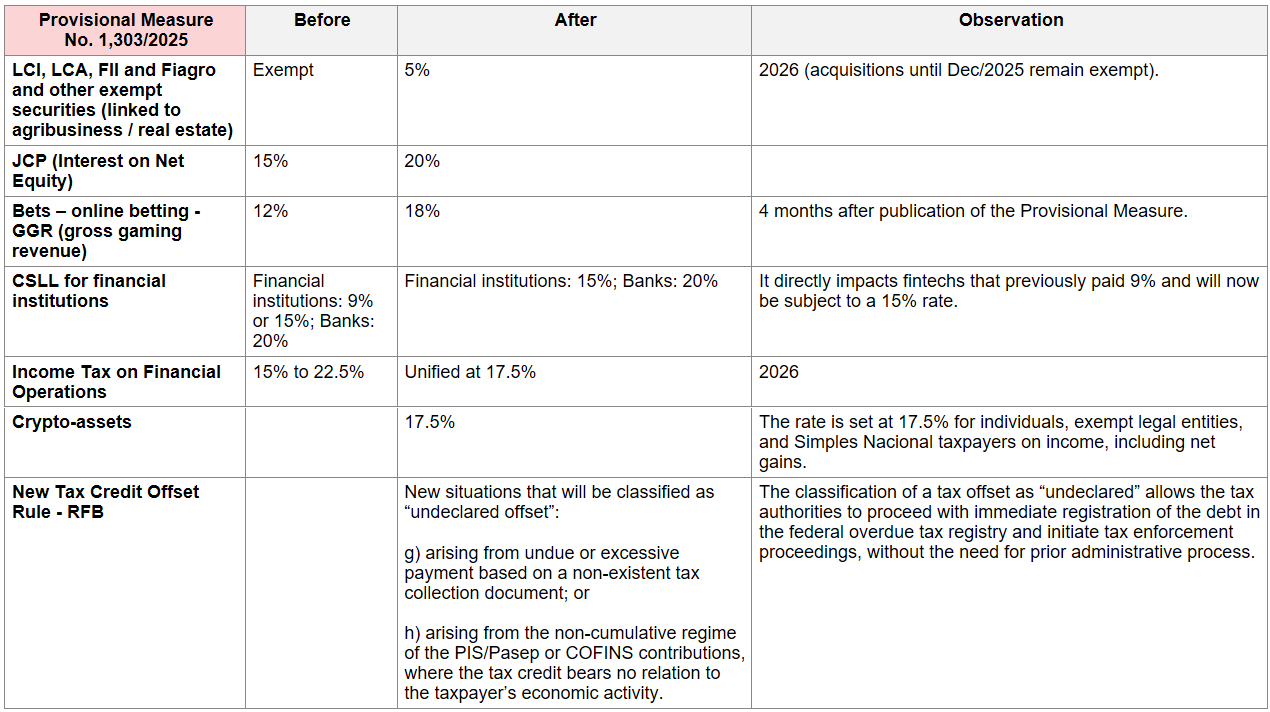

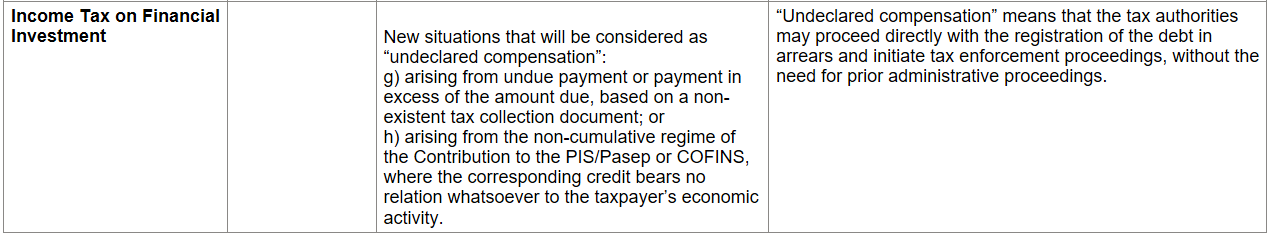

The Provisional Measure establishes new rules for taxation under the Income Tax (IR) regime on financial investments and virtual assets. In other words, it aims to offset the revenue loss from the Tax on Financial Transactions (IOF) by increasing or introducing IR taxation on financial investments (for example, impacting LCI/LCA, FIIs, Fiagros, bets, and standardizing IR on financial investments and the CSLL for financial institutions) and virtual assets such as crypto-assets, Bitcoin, etc.

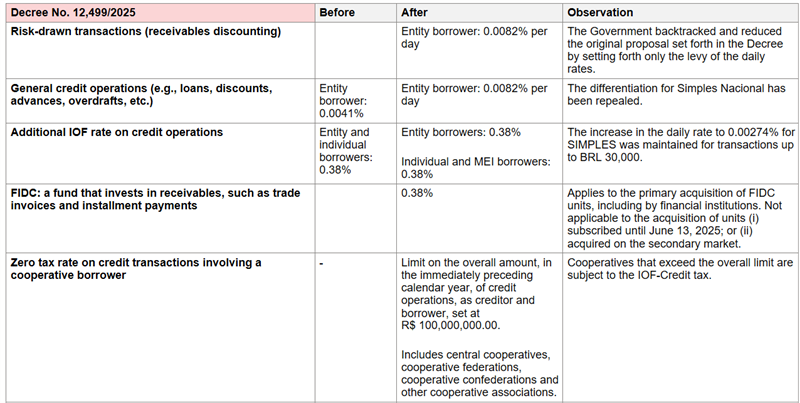

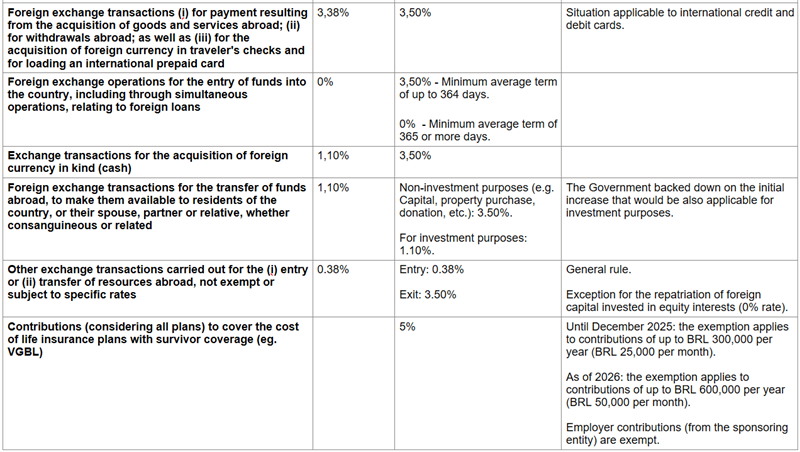

The Decree, in turn, introduces adjustments to the changes previously introduced by Decree No. 12,466/2025 to the Tax on Credit, Foreign Exchange, and Insurance Transactions, or Transactions Related to Bonds or Securities (IOF). In general terms, the new Decree revokes Decree No. 12,466/2025, bringing new provisions and potential reductions to the IOF in certain situations, such as risk-drawn operations and VGBL-type insurance policies, among others.

In more detail

Key Provisions of Provisional Measure No. 1,303/2025 and Decree No. 12,499/2025

Revenue Compensation Measures

- Standardization of the income tax rate on financial investments at 17.5%;

- 5% income tax (IR) on LCIs, LCAs, FIIs and Fiagros (previously exempt, in certain situations);

- Increase in the tax rate on sports betting from 12% to 18% on GGR (gross gaming revenue);

- Taxation of crypto-assets (e.g., Bitcoin);

- CSLL (Social Contribution on Net Profit) rate for financial institutions set between 15% and 20%;

- 10% reduction in tax expenditures;

- Stricter rules for the offsetting of tax credits.

IOF Reductions

- Levy only of the daily rate on risk-drawn transactions;

- Lower IOF rate for VGBL-type insurance policies;

- Minimum IOF rate for Credit Rights Investment Funds (FIDC);

- IOF exemption on the repatriation of foreign direct investments.

In summary, the following consolidates the provisions of the Provisional Measure No. 1,303/2025 and Decree No. 12,499/2025.

Most of the provisions of the Provisional Measure will enter into force on January 1, 2026. However, for that to occur, the Brazilian Congress must review the text of the Provisional Measure within 120 days, under penalty of loss of effectiveness.

The Decree, in turn, is immediately effective, although certain situations may give rise to discussions regarding the potential need to apply the ninety-day or annual anteriority rules.

This newsletter is only a general review of the subjects covered and does not constitute a legal opinion or consultation.