Bill of Law proposes progressive rates of up to 8% for ITCMD (Estate and Gift Tax) in the state of São Paulo

In summary

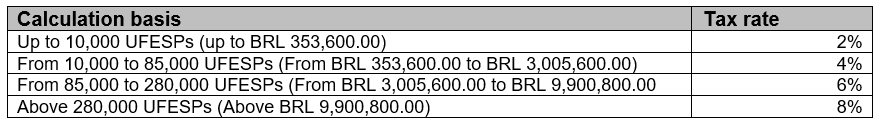

Bill of Law No. 7 of 2024 (“PL 7/2024”), proposed by State Representative Donato, aims at the amendment of State Law 10.705 of 2000, which provides for Estate and Gift Tax (so called “ITCMD”) in São Paulo, to establish progressive rates of up to 8%, as follows:

*Currently one UFESP corresponds to BRL 35.36.

It is worth mentioning that currently a flat rate of 4% is levied on the transfer of assets by way of donation or inheritance.

The purpose of the Bill of Law is to align the São Paulo State Law with the changes introduced by the Brazilian Tax Reform (Constitutional Amendment 132 of 2023). This amendment (among other changes) modified article 155, including item VI, to establish that the ITCMD will be progressive based on the value of the inheritance, legacy, or donation.

It is important to note that if PL 7/2024 is approved and converted into law in 2024, the principles of anteriority should be respected, meaning that the law that creates or increases ITCMD can only enter into force in the following year and after 90 days of publication. Therefore, the proposed changes should take effect only in 2025.

As a result, the 4% tax rate (without progressivity) will continue applying for 2024. This may present an opportunity for families to review their succession planning.