Brazil: Brazil and United Kingdom sign Double Taxation Agreement

In brief

On 29 November 2022, Brazil and United Kingdom signed a Double Taxation Agreement (“DTA”).

The DTA will enter into force after the conclusion of legislative procedures in Brazil and the United Kingdom and the exchange of notifications between the two jurisdictions.

More details

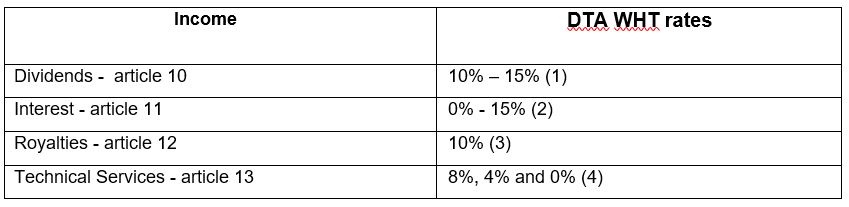

- Article 10 of the DTA may become relevant and attractive in the scenario of a possible tax reform in Brazil that establishes that the levy of Withholding Income Tax (WHT) over dividends distributed by Brazilian companies

- Article 11 establishes 15% as the general WHT rate over interest (including interest on equity), but provides an exemption for payments made to a pension plan or to the Government of the other Contracting State; 7% on interest paid to banks or insurance companies on loans for the financing of infrastructure projects and public utilities with a minimum term of 5 years and 10% in transactions with banks or insurance companies in general, bonds or securities traded on recognized stock exchange and on sale on credit on the acquisition of machinery and equipment;

- Most of the DTAs signed by Brazil provide for a 15% rate as a limitation for taxation by the WHT on the payment of royalties, with some exceptions subject to 10%. The DTA with the United Kingdom is therefore more beneficial in establishing the tax rate of 10% for all types of royalties;

- Unlike most DTAs already signed by Brazil, and in line with the most recent ones signed with Switzerland and Singapore, the DTA with the United Kingdom has a specific article regulating Technical Services and authorizing taxation at source on payments for remuneration for services of a managerial, technical or consulting nature. However, the DTA innovates by reducing the WHT rates to 8% during the first two years of its entry into force, 4% during the third and fourth years and 0% after the fourth year. Furthermore, Article 13 of the Protocol to the DTA states that if Brazil agrees on lower rates on technical services with any other OECD member country, except Latin American jurisdictions, such lower rates will automatically apply to the DTA between Brazil and the United Kingdom. These clauses reflect an important change in Brazil’s tax position and make the DTA a precedent capable of opening the way for the development of other negotiations with relevant commercial partners, such as the United States.

Another relevant innovation of the DTA is the provision, in Article 9, for the granting of corresponding transfer pricing adjustments through mutual agreement procedures. Historically, Brazil has always refused the commitment to apply corresponding transfer pricing adjustments due to the transfer pricing system currently adopted by Brazilian legislation. The wording of Article 9 of the DTA is in line with the OECD guidelines and with the possible convergence of Brazilian transfer pricing rules to the model provided for by the Organization.

The enjoyment of the benefits provided for by the DTA is, however, conditioned to the terms of Article 29, which aims to limit its application in scenarios presumed to be abusive, with the objective to avoid tax evasion.

As mentioned above, the DTA will enter into force after the conclusion of legislative procedures in Brazil and in the United Kingdom and the exchange of notifications between the two jurisdictions.

Trench Rossi Watanabe tax team is at your disposal to discuss the impacts of the DTA to our clients.