Federal Treasury Department enacts a program to pay with NOLs, debts included in tax settlement. Ordinance 8,798/2022

In brief

On October 10, 2022, the Federal Treasury Department published Ordinance PGFN/ME 8,798, which creates a Program for the taxpayers with certain tax settlement agreements celebrated with the Federal Treasury Department (or that will join until the end of October 2022), and for taxpayers with debts under such department unrecoverable or difficult to recover, to present a request to use tax losses and negative basis of social contribution on net profits accrued, to pay 70% of the remaining debts of said agreements.

More details

The Federal Treasury Attorney’s Office, now making use of the legal provision that authorizes the use of tax losses and negative CSLL tax basis for debts included in a tax settlement procedure, enacted Ordinance PGFN/ME 8,798 to enable taxpayers to use these credits to settle balances in these agreements.

The deadline to join the program will be from 11/01/22 to 12/30/22 and will only apply to debts enrolled in a tax debt registered at the Federal Treasury Department until 10/07/2022.

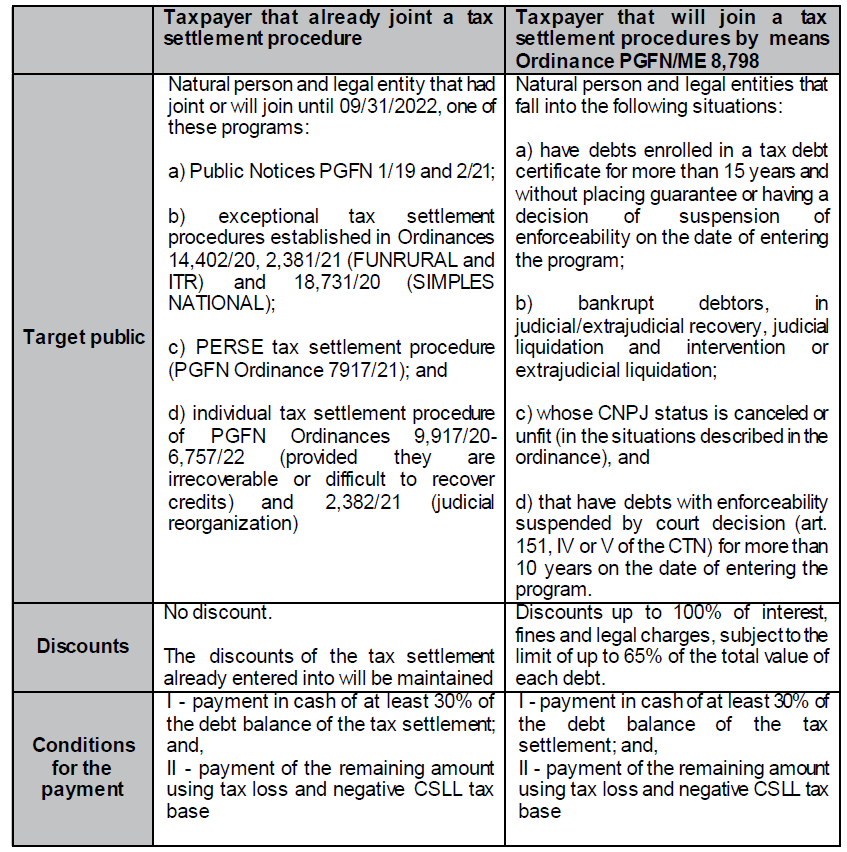

Regarding the benefits and target audience, the Ordinance established situations in which the taxpayer is already in the tax settlement procedure, as well as taxpayers who will join to the tax settlement procedure directly through this new program. The main information is summarized below:

We remain at your disposal to clarify any doubts.