Amendments to the tax legislation – LC 204/2023, MP 1202/2023 and IN 2168/2023

In brief

On December 29, 2023 relevant tax legislation was published:

- Complementary Law No. 204/2023 (“LC 204/23”), result of the President’s approval with veto of Complementary Law Project No. 116/2023, issued to adjust LC 87/1996 to the Federal Supreme Court decision rendered in ADC 49, which recognized the unconstitutionality of the levy of ICMS on the transfer of goods between establishments of the same legal entity.

- Provisional Measure No. 1.202/2023 (“MP 1202/23”), which (i) changed social security benefits on payroll, (ii) provides for new rules for offsetting tax credits and (iii) revoked the PERSE benefit for companies in the events industry.

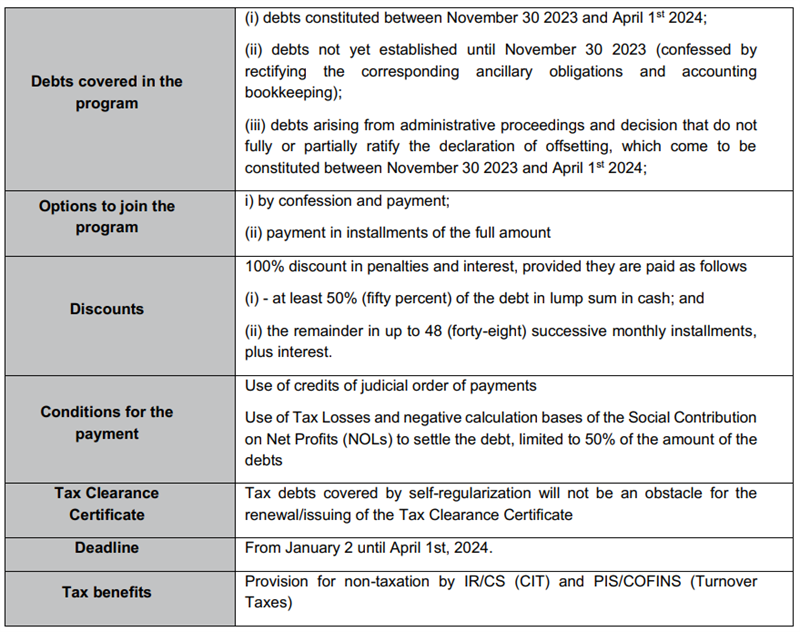

- Normative Ruling RFB 2.168/2023 (I”N 2168/23″), to discipline the incentivized self-regularization of taxes handled by the Brazilian Internal Revenue Service, with the waiver of interest and penalties, as established by Law 14740. Taxpayers will have up to April 1st 2024 to join the program.

In more detail

1.Complementary Law 204/23

The veto by the President of the Republic was in relation to the provisions of § 5 of PLP 116, which allowed taxpayers to keep the transaction as taxed, similarly to the procedure before the ADC 49 ruling.

In addition to that, ICMS Agreement No. 225, of December 21, 2023, was also published this week, dealing with the obligation to transfer credits, as provided ICMS Agreement No. 178/2023.

The publication of LC 204/2023 must be interpreted in light of ADC 49 trial, especially with regard to the mandatory transfer of credits. There are also relevant points in connection with ICMS Agreements 178 and 225/2023.

Finally, it is worth mentioning that the veto may be reanalyzed by the National Congress, with no schedule session yet set.

A. Social Security Contribution: creates a new benefit in relation to the reduction of the social security contribution – CPP rate on payroll and revokes the benefits of the CPRB, which had been extended until 2027, with effect from April 1, 2024.

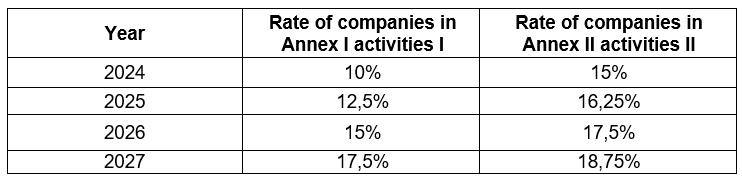

The new rule instituted the partial exemption of the social security contribution on payroll (reduction of the CPP rate), so that companies whose CNAEs are listed in Annexes I and II of the MP will be able to apply reduced CPP rates, as follows:

Note that the CNAEs covered by the new benefit are partially different from those previously encouraged by the CPRB.

Such rates will be applied to the insured’s contribution salary up to the value of one minimum wage, and the application is conditional on maintaining the number of employees (equal to or greater than) that verified on January 1st of each year.

B. Tax offsetting: The Provisional Measure established a monthly limit to the offsetting of tax credits arising from a final court decision. Such limit will be established by an act of the Minister of State for Finance (not yet published).

The monthly limit will be graduated according to the total amount of the credit, and cannot be less than 1/60th of the total amount of the credit, updated on the date of submission of the first declaration, and will not apply to credits below BRL 10,000,000.00 (ten million reais).

It is also determined that the first offsetting statement must be submitted within 5 years.

C.PERSE: Revocation of article 4 of Law 14.148, which instituted PERSE, a program aimed at companies in the events industry that reduced the rates of PIS/Pasep, Cofins, CSLL and IRPJ to zero. PERSE will gradually be phased out with the gradual resumption of the collection of taxes previously exempted.