Supreme Court judges the motion to clarify on the leading case of the exclusion of ICMS from the tax base of PIS

In brief

In the sessions held on the 12th and 13th of May 2021, the Supreme Court judged the motion to clarify filed by the National Treasury in the Extraordinary Appeal No. 574.706/PR, where the court decided for the exclusion of the ICMS from the tax base of the Social Contributions (PIS and Cofins).

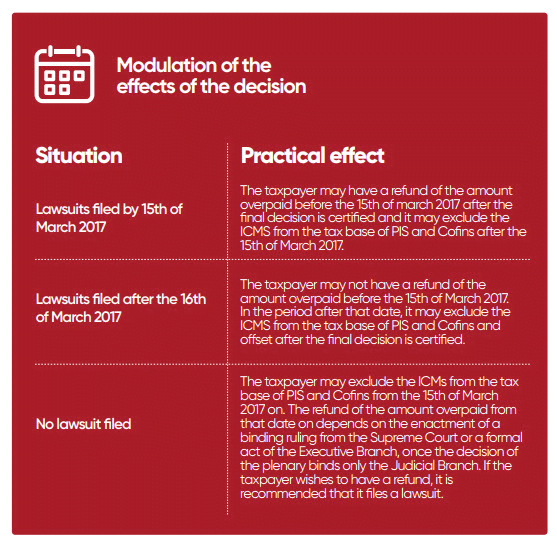

The motion to clarify was judged in part with grounds, in relation to the request for modulating the effects of the decision, limiting its effects from the 15th of March 2017 (date of judgement of the extraordinary appeal) on, except for the taxpayers who filed lawsuits before that date. Furthermore, the majority of the plenary clarified that the amount of ICMS that must be excluded from the tax base of the PIS and Cofins is the one indicated in the invoice.

More details

The Reporting Judge, Ms. Cármen Lúcia, stressed that in her vote presented in 2017 it is clear that the amount of ICMS that may be excluded from the tax base of PIS and Cofins is the ICMS indicated in the invoice and not the amount effectively paid by the taxpayer. She mentioned several extracts of her decision confirming that position.

In relation to the request for modulating the effects of the decision of the extraordinary appeal, Ms. Cármen Lúcia highlighted that, in her opinion, before that decision, the dominant jurisprudence stated that the ICMS may be included in the tax base of PIS and Cofins, so the decision rendered on the 15th of March 2017 changed the jurisprudence. Therefore, she decided that the decision has effects from the 15th of March 2017 on, except for the lawsuits that were filed before that date.

The majority of the Court Panel upheld Ms. Cármen Lúcia’s decision, judging in part with grounds the motion to clarify, assigning prospective effects of the decision rendered in 15th of March 2017, except for the lawsuits filed before that date, and clarifying that the ICMS that may be excluded from the PIS and Cofins tax base is the amount indicated in the invoice.

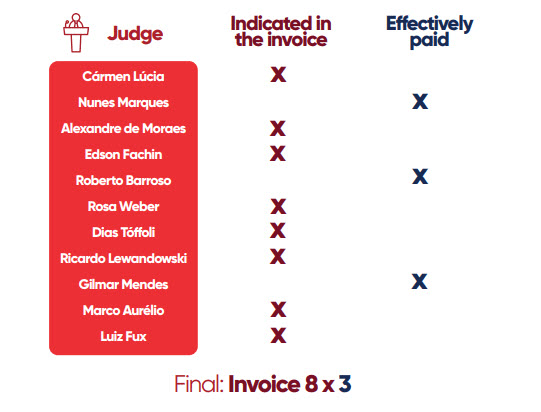

Please find below two tables showing the vote of each judge with respect to the amount of ICMS that may be excluded from the tax base of PIS and COfins and the practical effects of the prospective limitation of the decision:

ICMS – Indicated in the invoice vs. Effectively paid