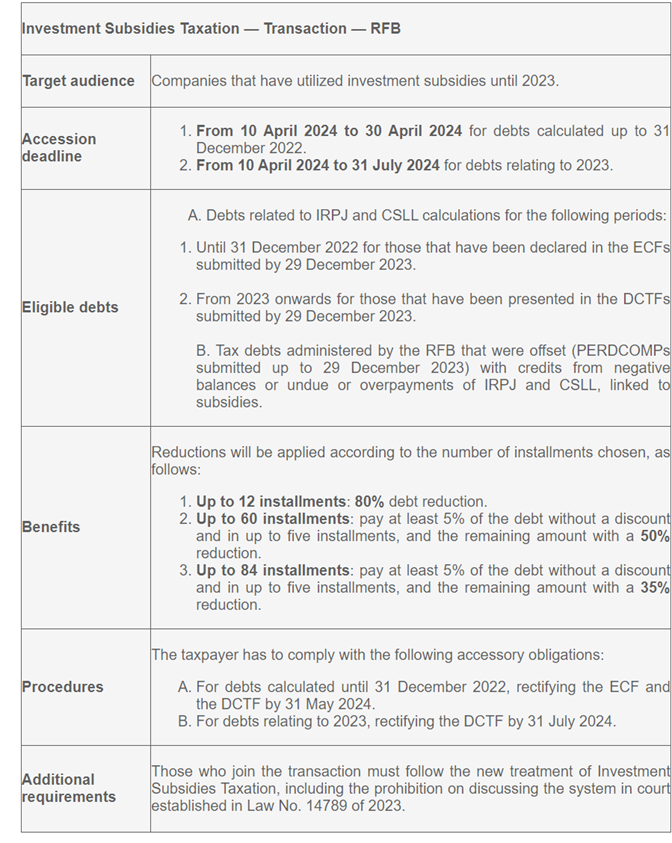

The RFB has issued IN RFB No. 2184/2024 regulating the thesis transaction regarding the Investment Subsidies Taxation

In brief

On 3 April 2024, the Federal Revenue of Brazil (RFB) issued Normative Instruction No. 2184/2024, which regulates the tax transaction provided in Article 14 of Law 14789/2023. This transaction aims to encourage companies to pay IRPJ and CSLL (corporate income taxes), resulting from the exclusion of investment subsidies made in disagreement with Article 30 of Law No. 12973 of 13 May 2014, provided that they have not been subject to assessment.

The deadline for joining the program is as follows:

- From 10 April 2024 to 30 April 2024 for calculation periods up to 31 December 2022.

- From 10 April 2024 to 31 July 2024 for calculation periods relating to 2023.

The transaction for debts registered as active debts of the RFB, provided in Article 13 of Law 14789/23, has not yet been regulated.

In depth

The main aspects of the program are: