Settlement program “Carioca em dia” enacted by the Municipality of Rio de Janeiro is already in effect

In brief

On May 12th, the Municipality of Rio de Janeiro enacted Decree # 52,449/2023, establishing conditions and benefits for taxpayers to settle tax and non-tax debts enrolled as Municipal executable tax debt, to which triggering events took place until December 31st, 2022.

Additional details

Exception is made by the program to debts resulting from the application of 250% increased fines, remarkably in cases of fraud or bad faith by the taxpayer – such as omission of revenues or undue deductions based on forged or false documents – as set forth by article 51, I, items 6 and 7 of the Municipal Tax Code.

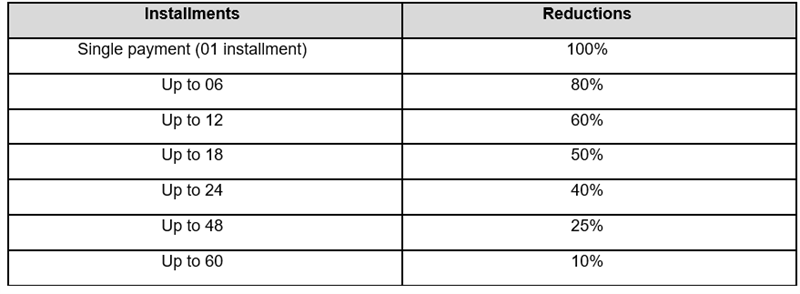

Despite such restrictions, the benefits provided by the program vary in accordance with the number of installments, and may reach up to 100% reduction of the default interest and fines if the payment is made in a single installment. The progressive reductions shall observe the following:

| Following the enactment of Ordinance PGM 21/2023 on May 15th, the program is already in full effect, and will be valid up until August 11th, 2023. |

The adhesion to the program shall be deemed complete upon payment of the first installment (or of the total amount in cash). It is important that companies willing to enjoy the program benefits observe and comply with the payment deadlines set by Decree # 52,449/2023, as the interruption or excessive delay (more than 60 days) in collecting such installments will result in the exclusion from the program with no need of notice from the Attorney General’s Office (PGM).

The program also foresees a proportional reduction in the attorney’s fees owed to PGM. However, the judicial costs due to the Court of Justice of the State of Rio de Janeiro (TJRJ) shall not be reduced, and the Court may charge any additional costs referring to the procedures required to conclude ongoing lawsuits.

The reductions set forth by Decree # 52,449/2023 cannot be enjoyed concomitantly with any other benefits granted by the Rio de Janeiro municipal legislation.

Similarly to the requirements imposed by programs offered on federal level, adhesion to the transaction represents (i) irrevocable confession of the debts included in the program, (ii) waiver of the right to administrative appeals or ongoing lawsuits related to such debts, and (iii) waiver of the right to raise factual or legal allegations to challenge such debts.