Suggested searches

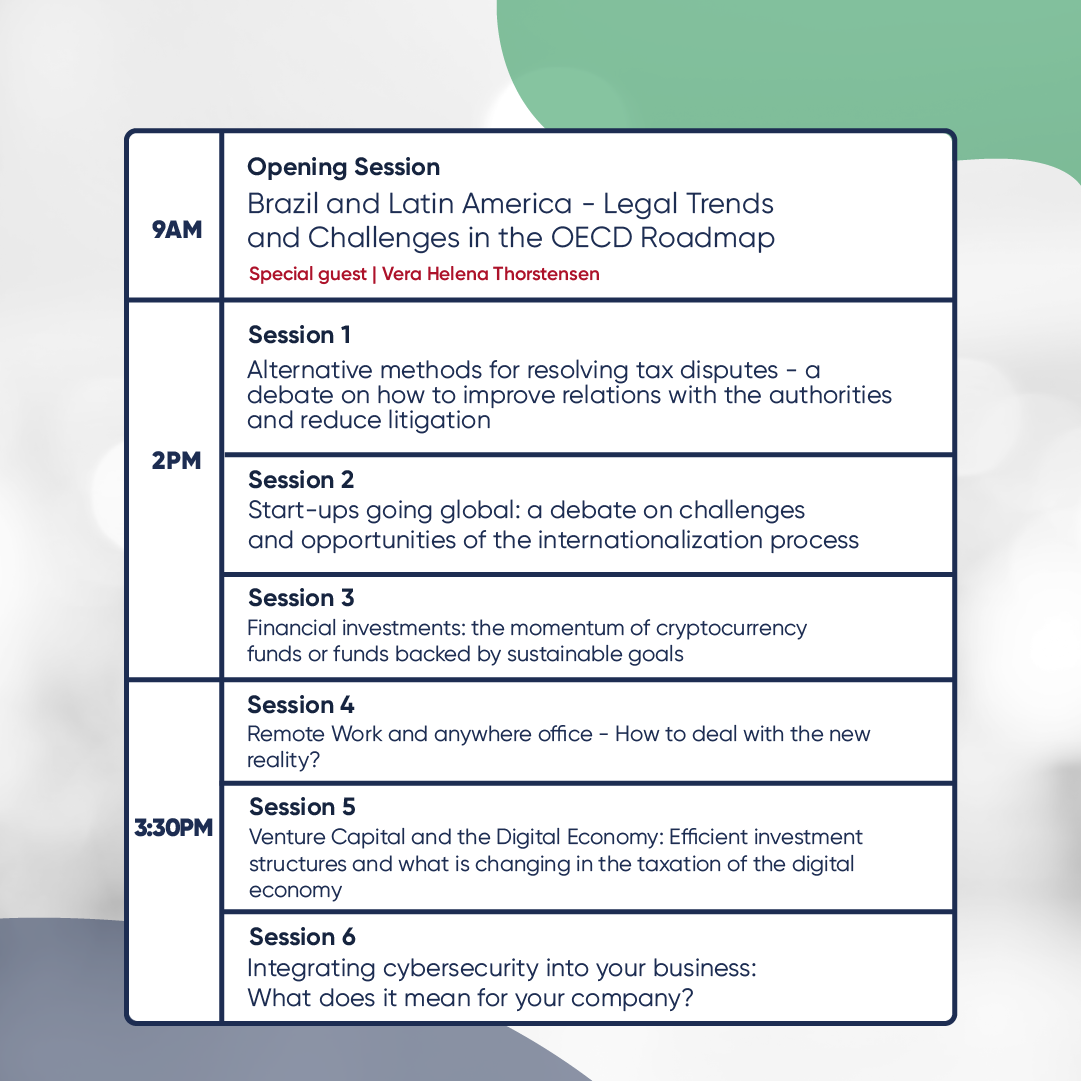

On August 30th, starting at 9AM, Trench Rossi Watanabe will host the International Conference for Multinationals, in its São Paulo office.

The morning plenary session will tackle the main legislative changes and trends concerning the Public Policy Script’s publication and Brazil’s admission into the OECD, a decision that should also include Peru and Argentina. Lecturers from Brazil, Argentina, Peru, Colombia and other countries will discuss the impacts of these changes and trends for multinational companies operating in Brazil and Latin America. Topics include the following: currency exchange flexibility; review of transfer pricing laws; improvement of corporate ESG practices such as environmental protection, biodiversity, integrity and governance; countries aptitude to combat unfair trade practices, such as cartels and corruption, at the national and international levels.

In the afternoon, six simultaneous breakout sessions will be held. Lecturers from Latin America, the United States and Europe will discuss topics such as the following: cybersecurity; alternative methods for resolving tax disputes; structuring of alternative investment funds; including cryptocurrency, sustainable products and carbon credits; remote work and anywhere office; relevant issues related to the internationalization of start-ups; digital economy and venture capital.

Agenda

Opening session: Brazil and Latin America –

Legal Trends and Challenges in the OECD Roadmap

9 AM

Opening session: Brazil and Latin America – Legal Trends and Challenges in the OECD Roadmap

Following the path already taken by Mexico, Chile, and Colombia, Brazil along with Argentina and Peru, received in January of 2022 the invitation to formally initiate the accession process to the OECD. In June, Brazil then received the script of public policies necessary for this entry.

The plenary session will present to multinational companies operating in Brazil the main changes in the law in fundamental themes.

For the banking sector, Law 14.286 was published, with effect from 31 December 2022, bringing exchange flexibilization in several aspects, whether as regards accessory obligations compliance, foreign currency accounts tolerance, or consignments from or to abroad. Royalty payments without the current limits to economic groups and centralization structures of cash are possible, with effects also in the tax and corporate areas, among others.

The current laws on transference prices are being reviewed, including in relation to the intangible corporate reorganizations as well as the digital economy, resulting from a joint work between the Brazilian Federal Revenue, the OECD, and the entities representing the business community. Events and discussions already disclosed the tendency of new laws that, without doubt, will affect the results division in multinational groups present in the country.

Regarding the public policies relevant to the ESG´s corporate practices — such as environment protection, biodiversity, integrity, and governance — important challenges will have to be overcome. The organization demands extensive measures to be aligned with the Paris Accord, which certainly shall involve new controls on pollutant emissions and the structuring of efficient carbon markets. Furthermore, the country must also demonstrate its capacity to fight unfair business practices, such as internal and international corruption, bribery, and cartel.

In all areas, the experience of Latin American countries that are already members of the OECD, as well as the experience in developed countries, can contribute to analyzing the trends in Brazil and the need for a normative evolution. Therefore, we will count with lecturers from Brazil, Argentina, Peru, Colombia, and other countries in this multidisciplinary panel that will be administered in person.

Moderators/Speakers

Partner of Trench Rossi Watanabe since 2002, Simone joined the firm in 1998, having worked in the Rio de Janeiro and São Paulo offices, where she is currently based. Her area of practice is tax law, consulting, follow-up on tax inspections and administrative proceedings, focusing on international taxation, transfer pricing, taxation applicable to acquisitions, associations and corporate restructuring, and Brazilian investments abroad. Member of the Administrative Committee of Trench Rossi Watanabe for two terms of office, she has participated in several projects involving the client development, communication and human resources areas, including restructuring of the partner remuneration system, modernization and optimization of the physical space and creation of the remote and flexible work policy. She is currently one of the leaders of the Corporate Social Responsibility Committee and an intense promoter of projects related to gender equity in the firm, especially those involving female leadership and minority inclusion. Simone is one of the leaders of the project for the inclusion of black students in the legal profession – Include Law, of CESA – Center for Studies of Law Firms, where she is a member of the Board of Directors for the term 2021 – 2024.

Professor and researcher at the FGV São Paulo School of Economics.

Coordinator of the Center for Global Trade and Investment at EESP-FGV.

Holder of the WTO Chair in Brazil.

Specialist in international trade regulation with 15 years of experience in Geneva.

Master’s and Ph.D. from EAESP-FGV, with a post-doctoral program at Harvard (USA), Centre for European Policy Studies (Brussels), and Visiting Scholar at the Inter-American Development Bank (Washington). She was the Economic Advisor to the Brazilian Mission to the WTO in Geneva from 1995-2010 and was a Professor of Foreign Trade Policies at the Institute of European Studies (IEE – Lisbon), Sciences-Po (Paris), and International Economic Law and Policy Institute (Barcelona). Former President of the WTO Committee on Rules of Origin, a position she occupied for seven years.

Paulo Casagrande joined the Firm in early 2020 as the partner in charge of the Antitrust & Competition group. Mr. Casagrande has 20 years of professional experience, both in the private and the public sectors. At the federal government, he was the first ever Head of the Bid Rigging Unit at the Secretariat of Economic Law of the Brazilian Ministry of Justice (SDE), the agency then in charge of investigating cartels before the reorganization of the Brazilian Competition Defense System in 2012. During his stint at the government, he conducted several investigations together with other enforcement agencies, and also represented the Secretariat at the meetings of the Competition Committee of the Organization for Economic Cooperation and Development (OECD) in Paris (France). While in the private bar, Paulo was a partner at leading international and Brazilian Law firms, and has a deep knowledge of several industries and a broad business vision. He has been especially active in the representation of clients before CADE (the Brazilian antitrust agency) in complex merger reviews and investigations of alleged anticompetitive practices. Casagrande has been recognized for his work in Antitrust & Competition by the main legal directories such as Chambers and Partners, Who’s Who Legal, The Legal 500, Leaders League, Latin Lawyer 250 and Análise Advocacia. Such experience also relies on significant academic credentials: Paulo graduated from the University of São Paulo Law School, the same institution from which he obtained a Doctorate (PhD) degree in Economics and Finance Law. He also holds a double LL.M degree from the Universities of Manchester (UK) and Hamburg (Germany), supported by a full scholarship from the European Commission (Erasmus Mundus programme). He was a visiting researcher at the Max Planck Institute for Research on Collective Goods (Bonn, Germany) and at Fordham Law School (New York, USA).

Clarissa Giannetti Machado Miras Clarissa Giannetti Machado joined the Firm in 1999 and became partner in 2007. She is the Head of the tax practice group. Her focus is tax consulting on corporate income and other federal taxes. Clarissa has extensive experience in the elaboration and analysis of global transfer pricing analysis and its effects vis-à- vis the local legislation. She has a wide breadth of experience in the assistance of clients for the development of efficient structures in M&A transactions, local and international restructurings, real estate and financing transactions. She also advises individuals on wealth management matters. Clarissa is the Head of the Pro-Bono Committee, being a member of the Social Responsibility team of the firm. She has worked for Ablfs McKfnzif, in the Chicago office, where she was member of the tax group focused on Latin America transactions. She also worked for Ablfs McKfnzif, in the Amsterdam office, where she was a member of the global transfer pricing group. She is registered with the New York Bar Association. Clarissa has been recognized for her work in the tax field by the main legal directories such as Chambers, International Tax Review (ITR), Legal 500, LACCA, Leaders League, Latin Lawyer, Who’s Who Legal and Análise Advocacia 500.

Felipe Noronha Ferenzini joined the firm in 2009 and became a partner in 2018. He co-coordinates the Compliance and Investigations Group in Brazil. Felipe has vast experience in the Compliance area, with focus on structuring and leading complex internal investigations, implementation of Compliance, Risk and Governance programs (risk assessment, internal policies, remediation mechanisms, trainings). Felipe also has a relevant background in Administrative Law and related sanctions regime. He also has robust experience in advising foreign and Brazilian companies regarding compliance laws (Brazilian Anticorruption Laws, FCPA, money laundering and regulatory compliance – pharma, oil and gas, banking, among others) dealing with relevant stakeholders (authorities, regulators, internal and external auditors, Board of Directors, regulatory agencies, independent oversight committees). He worked at the London and Mexico Ablfs McKfnzif offices in connection with compliance and infrastructure matters. Felipe has been recognized for his work as a Compliance expert in Brazil by renowned ranking such as Chambers 2022 edition, Legal 500 – Next Generation Partner – 2021 edition, LACCA (Latin America Corporate Counsel Association) – 2020 and 2021 (being appointed as a Thought Leader and the third most voted lawyer in all areas in Brazil for the 2021 edition). He is also certified by the Association of Certified Fraud Examiners – ACFE, New York 2018; certified by the Association of Certified Anti-Money Laundering Specialists – ACAMS – 2020 and alumnus of the International Anticorruption Academy-IACA (scholarship granted).

Luis Ambrosio has more than 25 years of experience in financial law. He joined the Firm in 2015 and is a partner of the Banking and Financial Law and Project Finance group. His work and expertise are focused on debt, both local and international. He has a wide breadth of experience in bank financing operations, capital market, project finance and debt restructuring, having participated in high profile cases. Luis Ambrosio frequently represents financial institutions and corporate clients in highly complex financial transactions. Luis has been recognized for his work in financial law by the main legal directories such as LACCA Thought Leaders, Chambers Latin America and Global, IFLR 1000, LACCA Approved, Leaders League, Latin Lawyer 250 and Legal 500 – Latin American.

Renata Campetti Amaral joined the firm in 2002 and became a partner in 2013. She is the head of the firm’s environmental law and sustainability group in Brazil. Renata is also the firm’s Energy, Mining and Infrastructure representative in Latin America for sustainability matters. She was chosen by Client Choice as Brazil’s environmental law representative, and, for the past several years, she has been recognized by Chambers, LACCA, Latin Lawyer and Legal 500 as one of the most admired environmental lawyers in Brazil. Renata leads several of the largest environmental and regularization cases in the country. She has extensive experience in sustainability and climate change matters, as well as in managing crises and negotiating with stakeholders. She holds an LL.M. from the University of Texas – Austin, and she specialized in ESG and Sustainability at Berkeley University. Renata is a lecturer and professor of post-graduate courses in environmental law and ESG matters.

Dr. Carlos Linares Garcia is a Principal Economist in Mexico and the head of Ablfs McKfnzif’s North America and Latin America Transfer Pricing practices. He is knowledgeable in the fields of transfer pricing, financial valuation and international taxation. His professional experience includes over 20 years in consulting and three years in the public sector. From 1993 to 1995, Dr. Linares was a deputy director with the International Tax Department of the Mexican Ministry of Finance in Mexico City. From 1996 to 1999, he was an associate economist at Houston-based Baker & Associates Energy Consultants and from 2000 and 2004, he was a senior manager and a partner in the energy economics and transfer pricing group at a big-four firm in Houston and Monterrey. For his research in economics and public finance, Dr. Linares received the Banamex Economics Award in 2000, as well as the Inter-American Social Security Award in 2002. He has lectured at various institutions such as the International Bureau of Fiscal Documentation, Rice University, Instituto Colombiano de Derecho Tributario, Universidad Autónoma de Nuevo León and the Tecnológico de Monterrey.

Dr. Linares received his degree in Economics summa cum laude from Universidad Autonoma de Nuevo Leon in 1993 and his Masters and Ph.D. degrees in Economics from Rice University in 2000, specializing in public finance and tax policy. Also, he obtained a Diploma in International Taxation from Harvard University and a Diploma in Energy Law from Universidad de Monterrey. He is an active member the International Fiscal Association (Transfer Pricing Committee), the Instituto Mexicano de Ejecutivos de Finanzas, the Asociación Nacional de Especialistas Fiscales, and Vice-President of the Colegio de Economistas de Nuevo Leon.

Ciro is a lawyer graduated from Pontificia Universidad Javeriana and a specialist in Tax Law from Universidad del Rosario. In 2006 he obtained a LL.M. degree in International and Comparative Law from Tulane University in New Orleans, LA, USA.

Over almost 20 years, he has advised companies in the oil and gas, pharmaceutical, technology, mass consumption and mining sectors, on matters related to tax planning and consulting, and litigation. From 2006 to 2010, he worked as a tax manager at Deloitte Colombia. Prior to this, he served as associate for two firms focused on tax and international trade. He has also been a professor of tax law courses at Pontificia Universidad Javeriana, Universidad Externado de Colombia and Universidad ICESI.

Ciro joined Ablfs McKfnzif in 2010, and since 2014 he heads the Firm’s Tax practice group in Bogotá.

Martin Barreiro is experienced in various areas of tax law. He is a member of the Buenos Aires Bar Association, the American Chamber of Commerce in Argentina, the Tax Sub-Committee and the Argentine Association of Taxation Studies. His extensive list of publications include “New Argentine Social Security System” for the International Company and Commercial Law Review and “The S.R.L. in the tax planning of US investors in Argentina” for the Economic and Tax Journal.

Pablo Berckholtz is the head of Estudio Echecopar’s Banking & Finance practice in Lima and Chair of Latin America Capital Markets Steering Committee. He focuses on capital markets, corporate finance and derivatives, with experience in initial public offerings, high-yield debt and project bonds, representing both issuers and investment banks. He also has experience in derivatives matters, advises derivatives counterparties on regulatory and other Peruvian law matters.

Roberto Grané is a transactional and regulatory partner in Ablfs McKfnzif’s Buenos Aires office. He has been recognized as a leading Corporate/M&A practitioner by Chambers and Partners. Prior to joining Ablfs McKfnzif, Roberto served as in-house counsel to one of the major telecommunications companies in Argentina, and a law clerk with the Civil Courts of the city of Buenos Aires.

He is an Adjunct Professor of Contracts Law at the Buenos Aires University and a visiting professor in several local universities. He is a member of Ablfs McKfnzif’s M&A Latin America Steering Committee as well as a member of the Firm’s Global CG&R Steering Committee.

Moderadora: Simone Musa, sócia de Trench Rossi Watanabe

Isaias Coelho, assessor especial do ministério da economia e pesquisador sênior do núcleo de estudos fiscais da FGV

Antonio Russo, sócio de Ablfs McKfnzif Amsterdã

Sócia de Trench Rossi Watanabe desde 2002, Simone ingressou como advogada em 1998, tendo trabalhado nos escritórios do Rio de Janeiro e de São Paulo, onde está atualmente baseada. Sua área de atuação é direito tributário, consultoria, acompanhamento a fiscalizações e processos administrativos, com foco em tributação internacional, preços de transferência, tributação aplicável a aquisições, associações e reestruturações societárias, e investimentos brasileiros no exterior. Integrante do Comitê Administrativo de Trench Rossi Watanabe há dois mandatos, participou de diversos projetos envolvendo as áreas de desenvolvimento de clientes, comunicação e recursos humanos, incluindo reestruturação do sistema de remuneração de sócios, modernização e otimização do espaço físico e criação de política de trabalho remoto e flexível. É, atualmente, uma das líderes do Comitê de Responsabilidade Social Corporativa e intensa incentivadora de projetos relacionados à equidade de gêneros no Escritório, sobretudo envolvendo liderança feminina e inclusão de minorias. Simone é uma das líderes do projeto para inserção de estudantes negros na advocacia – Incluir Direito, do CESA – Centro de Estudos das Sociedades de Advogados, onde integra o Conselho Diretor para o triênio 2021 – 2024.

Isaias Coelho – bio Assessor Especial do Ministro da Economia. Economista; graduação pela PUC Campinas, mestrado (Teoria Econômica) pela UFBa, doutorado (Economia Internacional e Finanças Públicas) pela Universidade de Rochester. Professor do FGVLAW da FGV Direito SP e coordenador do Núcleo de Estudos Fiscais (NEF) da FGV. Ex Secretário da Receita Federal Adjunto, Professor Adjunto da UnB (Economia) e chefe da Divisão de Política Tributária do FMI.

Antonio Russo is an established practitioner of international tax law. He is a partner with Ablfs McKfnzif Amsterdam’s award-winning Transfer Pricing Team. Antonio lectures at numerous seminars and conferences around the world, as well as contributes articles to several international tax reviews. He has been a member of the International Fiscal Association (IFA) since 2001. Since July 2019, Antonio is Chair of the Global Tax Practice Group.

Antonio specializes in Transfer Pricing design, implementation and valuation of companies and intangible assets. He has extensive experience in tax planning/restructuring engagements, and has performed TP studies for clients in numerous industries. Antonio has also provided assistance to clients in developing strategies for the conclusion of APA’s as well as tax audit defense in Europe and the USA.

Session 1

Alternative methods for resolving tax disputes ̶ a debate on how to improve relations with the authorities and reduce litigation

2 PM

Session 2

Start-ups going global: a debate on challenges and opportunities of the internationalization process

2 PM

Session 3

Financial investments: the momentum of cryptocurrency funds or funds backed by sustainable goals

2 PM

Session 4

Remote Work and anywhere office- How to deal with the new reality?

3:30 PM

Session 5

Venture Capital and the Digital Economy: Efficient investment structures and what is changing in the taxation of the digital economy

3:30 PM

Session 6

Integrating cybersecurity into your business: What does it mean for your company?

3:30 PM

Alternative methods for resolving tax disputes – a debate on how to improve relations with the authorities and reduce litigation

This session will focus on recent developments and opportunities for alternative dispute settling as compared to traditional administrative and judicial tax controversies. Our tax practitioners will discuss the measures that have been adopted in certain jurisdictions to improve the relationship between tax authorities and taxpayers to positively impact the reduction of litigation and increase predictability and security when it comes to tax assessments and risks.

Moderators/Speakers

Rafael Gregorin joined the Firm in 2002 and became partner in 2018. He integrates the tax practice group, with focus on litigation. Gregorin has a wide breadth of experience in tax and customs litigation, representing clients in disputes involving federal, state and municipal taxes. He has worked in Ablfs McKfnzif Chicago in the tax practice group. Rafael Gregorin has been recognized as one of the most admired tax litigation lawyers by Análise Advocacia 500 and Lacca Approved.

Maria Rita Ferragut joined the Firm in 2019 as partner. She has 25 years of experience and coordinates the Tax Litigation practice group, working with judicial focus at the federal, state and municipal levels. Full professor in Tax Law at Universidade de São Paulo (USP), holds a doctorate and a master’s degree in Tax Law from Pontifícia Universidade Católica de São Paulo (PUC/SP) and graduated from Pontifícia Universidade Católica de São Paulo (PUC/SP) with a degree in Law. She is a Law professor at Instituto Brasileiro de Estudos Tributários (IBET) and Pontifícia Universidade Católica (PUC/COGEAE). She has already taught at Pontifícia Universidade Católica de São Paulo (PUC/SP), INSPER and Fundação Instituto de Administração (FIA/SP). She was an assistant professor in the master’s and doctorate in Tax Law at Pontifícia Universidade Católica de São Paulo (PUC/SP) and Universidade de São Paulo (USP) for 12 years. Participates in several congresses and seminars in the country.

Vice-Chairman of the Tax Litigation Commission of the Brazilian Bar Association – OAB/SP. Vice-President of the Tax Law Commission of São Paulo Lawyers Institute – IASP. Member of the board of the Advocacy Defense Movement – MDA. Director of WIT – Woman in Tax Brazil. Ex-member of the board of Geraldo Ataliba Institute of Public and Business Law- IGA/IDEPE. Maria Rita Ferragut received the CARF Award for Monographs in Tax Law – 2010 (Prêmio CARF de Monografias em Direito Tributário 2010) from the Administrative Council for Tax Appeals.

She has been recognized for her work in Tax by the main national and international legal directories such as Chambers & Partners, The Legal 500, Leaders League, Análise Advocacia Mulher and Análise Advocacia 500.

Ciro is a lawyer graduated from Pontificia Universidad Javeriana and a specialist in Tax Law from Universidad del Rosario. In 2006 he obtained a LL.M. degree in International and Comparative Law from Tulane University in New Orleans, LA, USA.

Over almost 20 years, he has advised companies in the oil and gas, pharmaceutical, technology, mass consumption and mining sectors, on matters related to tax planning and consulting, and litigation. From 2006 to 2010, he worked as a tax manager at Deloitte Colombia. Prior to this, he served as associate for two firms focused on tax and international trade. He has also been a professor of tax law courses at Pontificia Universidad Javeriana, Universidad Externado de Colombia and Universidad ICESI.

Ciro joined Ablfs McKfnzif in 2010, and since 2014 he heads the Firm’s Tax practice group in Bogotá.

George Clarke is a partner in the Firm’s North America Tax Practice Group in Washington, DC and chair of the Firm’s North American Tax Dispute Resolution Group. His practice focuses on tax litigation and he is nationally-known for his work in civil and criminal tax matters. George has authored several articles on tax law and is a contributor to various blogs and publications. He is consistently recognized by Legal 500 as a leading adviser in tax controversy. George also lends his talent to pro bono matters and has successfully represented non-enemy combatants unlawfully detained by the US in Guantanamo Bay, Cuba and is lead counsel in a case to force the President to retain materials under the Presidential Records Act. He is a certified public accountant (inactive). Before becoming a lawyer, he served in the US Marine Corps.

Martin Barreiro is experienced in various areas of tax law. He is a member of the Buenos Aires Bar Association, the American Chamber of Commerce in Argentina, the Tax Sub-Committee and the Argentine Association of Taxation Studies. His extensive list of publications include “New Argentine Social Security System” for the International Company and Commercial Law Review and “The S.R.L. in the tax planning of US investors in Argentina” for the Economic and Tax Journal.

Start-ups going global: a debate on challenges and opportunities of the internationalization process

Brazil has already proven itself to be one of the main fomenters and exporters of unicorn companies and is the apple of foreign investors’ eyes. In this panel, we will present the main point of attention and opportunities to ensure legal and tax efficiency of the internationalization process of Brazilian startups, from the investment phase, over the international expansion of operations (incorporation of non-Brazilian entities, transfer of functions, intangibles and risks to abroad, etc.) up to the long-awaited IPO.

Moderators/Speakers

Luciana Nobrega joined the Firm in 2010, worked for two years as a tax advisor in Luxembourg and one year as a member of the international reorganizations group at Ablfs McKfnzif in London. She works in the tax planning and consulting areas of the Tax group, focusing on international operations. She has vast experience in supporting Brazilian companies expanding or reorganizing abroad, including planning and tax support for corporate reorganizations, transfer pricing issues and alignment with foreign tax authorities (obtaining APAs and rulings), structuring and implementing investment funds in Brazil and abroad, and domestic and international financial transactions. Luciana also has experience in coordinating corporate implementation of multi-jurisdictional projects. Recognized as one of the most admired lawyers in Brazil by the yearbook Análise Advocacia 500 (2021) and mentioned by The Legal 500 in the categories Tax Consulting, Customs and Tax Litigation (2022).

Felipe Katlauskas Calil has joined the firm in 2007, and became partner in 2019. He practices corporate and securities law, mergers & acquisitions and commercial contracts law, in addition to insurance and private pension compliance. He is focused in transactions involving multinationals, public companies, pension funds and investment funds. Specialist in the preparation and negotiation of corporate agreements (e.g., equity purchase and sale agreements, joint venture agreements and shareholders agreements, etc.) as well as commercial agreements (e.g., distribution and supply, sales agency, real estate leases, services agreements, among others). He has broad experience in the development and review of corporate governance processes and routine corporate matters of companies, corporate restructuring transactions, among others. Consolidated knowledge and practice in capital markets transactions, such as public offerings for the acquisition and distribution of shares and other securities, negotiation of securities and derivatives, organization of investment funds, as well as in compliance with Brazilian securities laws and regulations.

Flávia Amaral returned to the firm in 2021. She works in the IP Tech group with a focus on Intellectual Property, Technology, Data Protection, Privacy, Cybersecurity and Franchise. She represents Brazilian and foreign clients in different industry segments, such as fashion and luxury, health, beauty and well-being, medical products, electronics, technology, automotive and retail. In addition, Flávia is a member of the Legal Studies Commission of the ABF – Associação Brasileira de Franchising (Brazilian Franchising Association); Coordinator of the Intellectual Property and Fashion Law Nucleus of the Italo-Brazilian Chamber of Commerce, Industry and Agriculture – Italcam and was Assistant Cultural Director at the ASPI – Associação Paulista de Propriedade Intelectual (São Paulo Intellectual Property Association). Flávia Amaral was recognized for her work in the field of Intellectual Property by LACCA, Análise Advocacia 500 and Análise Mulher.

Financial investments: the momentum of cryptocurrency funds or funds backed by sustainable goals

An increasingly challenging global market and the emerging of new tendencies and technologies are attracting investors to alternative investments in search of higher returns, conscious and sustainable investments, or investments in line with new technologies such as ESG, carbon credits, cryptocurrencies, stablecurrencies, blockchain and NFTs. The offering of new investment products, including through investment funds in Brazil and abroad, promotes access to markets and assets that previously were not easily available. The panel will discuss the main regulatory and tax aspects affecting such new alternative investments.

Moderators/Speakers

Reinaldo Ravelli Neto joined the Firm in 2005 and became partner in 2016. He integrates the tax practice group, with focus on tax planning and transactions. Mr. Ravelli has a wide breadth of experience in tax advisory for Foreign Investments, Mergers & Acquisitions (M&A), Corporate Reorganizations, Financial Transactions, Investment Funds, Real Estate Transactions and Project Financing. Ravelli has been recognized by several legal directories such as Latin Lawyer 250, Legal 500, International Tax Review and Lex Latin for the transactions he advised and coordinated.

Evaristo Lucena joined the Firm in 2020 and became partner in 2022. He integrates the Transactional practice group, with focus on corporate, mergers and acquisitions, and capital markets. Specialized in corporate law and capital markets. He represents issuers, shareholders, and financial institutions in transactions involving structuring, registering, and listing of companies in regulatory agencies and the stock market. He also acts in operations of mergers and acquisitions. He has worked in Ablfs McKfnzif New York and Toronto as part of the equity capital markets and M&A team. Admitted to the NY State Bar and the by the Law Society of Ontario.

As Legal Counsel and Relationship Manager, for the last 10 years, Fernanda worked in the financial market in companies such as Banco Fator, BTG Pactual, and XP Investments, with an emphasis on providing advice to clients on investments and succession planning.

At BTG Pactual, she created a new infrastructure insurance company with 8 other members and acted as a specialist in legal and political affairs, as well as operational procedures. Prior to the financial market, she worked for 5 years at one of the most renowned law firms in Brazil, Veirano Advogados, where she was responsible for cases related to tax litigation, tax and social contribution consulting services concerning direct and indirect taxation, social security payments and customs issues.

Fernanda is a lawyer who graduated from Fundação Armando Alvares Penteado – FAAP; she completed a specialization in Business Administration from Insper and holds an MBA (Master in Business Administration) focused on Finance from the University of Noth Carolina.

Legal Advisor at Hashdex

Over 7 years of experience with capital markets and corporate law

Master of Laws in Corporate Law and Blockchain from Universidade Federal de Minas Gerais (UFMG)

Bachelor of Laws from Federal University of Minas Gerais (UFMG)

Director of GEDEMP – Corporate Law Study Group

Remote Work and anywhere office- How to deal with the new reality?

The pandemic has changed the way we all work, bringing down frontiers. With that, the “anywhere office” phenomenon has become increasingly common. Although it represents a significant advance, this new work modality triggers employment, tax, and immigration implications. At this panel, we will discuss how to implement the anywhere office mitigating risks for the company.

Moderators/Speakers

Leticia Ribeiro C. de Figueiredo joined the Firm in 1998, as a corporate trainee, and became partner in 2013. Until July 2003, she was primarily involved in M&A and Corporate Law, with experience in national and international M&A projects and corporate restructurings. From July 2003 on, she has been working exclusively in the Labor Law practice group. She has a wide breadth of experience with strategic litigation cases and relevant consultancy in individual and collective matters (i.e. restructuring, equity pay, PDVs – voluntary resignation program, PLRs – participation in profits or results, alteration of compensation plans and benefits), including national and international projects. Additionally, she works with collective bargaining agreements. Leticia has been recognized for her work in the Labor area by the main legal directories such as Chambers and Partners, Latin Lawyer 250, The Legal 500, Leaders League and Análise Advocacia 500.

Mariana Neves de Vito joined the Firm in 1998 and became partner in 2012. She integrates the tax practice group, with focus on social security matters and other taxes related to labor relations. Mariana has a wide breadth of experience in advisory and tax litigation (judicial and administrative). She represents clients in the automotive sector, pharmaceutical, chemical, hygiene products and cosmetics, retailing, agribusiness and services, among others. She has worked in Ablfs McKfnzif Chicago office and also in Sydney, Australia. Mariana has been recognized for her work in the tax field by the main legal directories such as ITR – International Tax Review, LACCA Approved and Análise Advocacia 500.

Clarissa Lehmen joined the Firm in 2014. She integrates the employment & compensation practice group, with focus on employment advisory, assisting companies in strategic matters. Clarissa has a wide breadth of experience in strategic matters, including defining and implementing strategies for labor matters relating to C-level executives, benefits harmonization, expatriation, outsourcing, due diligence audits related to Mergers & Acquisitions, retention schemes, Stock Options and negotiations with labor unions. Clarissa has been recognized for her work in the Labor area by the main legal directories such as Analise Advocacia 500 and Analise Advocacia Mulher – Full Service.

Paulo Roberto Gomes de Carvalho joined the Firm in 2010. He integrates the tax practice group, with focus on taxation upon compensation. Paulo has a wide breadth of experience in the social security contributions income tax, strategic compensation, stock plans, expatriations and private pension. He graduated from Pontifícia Universidade Católica de São Paulo with a degree in Law, and also holds a master’s degree in Constitutional Tax Law from Pontifícia Universidade Católica de São Paulo and Pension Funds from FIPECAFI.

Alberto Gonzalez Torres practices in the area of employment law. He is a member of the Buenos Aires Bar Association and the San Isidro Bar Association. Alberto frequently contributes to The Global Employer — a Firm-sponsored publication — and has served as speaker for several Ablfs McKfnzif conferences. He also co-authored Argentina’s Proposed Labor Law Agreements for the National Law Center.

Ciro is a lawyer graduated from Pontificia Universidad Javeriana and a specialist in Tax Law from Universidad del Rosario. In 2006 he obtained a LL.M. degree in International and Comparative Law from Tulane University in New Orleans, LA, USA.

Over almost 20 years, he has advised companies in the oil and gas, pharmaceutical, technology, mass consumption and mining sectors, on matters related to tax planning and consulting, and litigation. From 2006 to 2010, he worked as a tax manager at Deloitte Colombia. Prior to this, he served as associate for two firms focused on tax and international trade. He has also been a professor of tax law courses at Pontificia Universidad Javeriana, Universidad Externado de Colombia and Universidad ICESI.

Ciro joined Ablfs McKfnzif in 2010, and since 2014 he heads the Firm’s Tax practice group in Bogotá.

Venture Capital and the Digital Economy: Efficient investment structures and what is changing in the taxation of the digital economy

Venture capital funding in the digital economy is not about to stop. The success of its startups has turned Brazil into an attractive place for diversification and asset allocation. Recent legislation, such as Law 182/2021, has aided the fostering of investments, along with the maturity of the ecosystem. Further, a new chapter was opened with the debut of startups in capital markets. In this session, you will learn what a venture capital manager considers in the decision-making related to tech companies and how efficient structures may help the investment to be successful. The session will also cover some Corporate Venture Capital (CVC) trends and challenges, as well as tax aspects related to the funding and potential impacts of the proposed tax reform to the industry.

Moderators/Speakers

Adriana Stamato leads the group of indirect taxes, working with in consulting and litigation matters. She has extensive experience in assisting clients in corporate reorganizations, tax planning, risk assessment, tax inspections, modeling of new businesses, obtaining special regimes, among others. Adriana also has extensive experience in analyzing the different tax regimes applicable to each sector, having assisted clients in selecting the best business model for implementing structures in Brazil. She represents customers in the automotive, technology, energy, food, pharmaceutical, chemical, hygiene and cosmetics, retail, agribusiness and services, etc. Adriana has been recognized for her work by the main legal directories. In the 2021 edition, she has been recognized by LACCA Approved as a Thought Leader. In addition, she has been nominated for several years by the ITR in the indirect area Women in Tax and has been recognized by The Legal 500.

• Strong Background in finance with substantial experience in Venture Capital and Private Equity, M&A, Corporate Finance and Corporate Banking. Hands-on approach to projects.

• Seasoned M&A executive (+16 years) , with exposure to many deals involving diverse Industries (Venture Capital, Finance, Infrastructure – Water and Waste/Energy/Telecom/Logistics, Education, Retail et cetera).

• Experienced in liaising with all parties of a deal, such as Private Equity Houses, Target Companies, Banks and Financial Due Diligence teams, both on sell & buy side.

• Extensive relationship network with VCs, entrepreneurs, incubators, accelerators and government funding agencies.

• Deep knowledge of innovation and technology trends and market drivers.

• Experience in the strategic planning/management of business in the corporate and consumer segments of different industries.

• Specialties: Negotiation, M&A, product development and strategy, marketing strategy, strategic planning, project management, financial analysis, corporate governance, portfolio management, business valuation.

Paula Alonso joined the Firm in 2016. She integrates M&A and Capital Markets Practice Group with focus on Corporate Law matters and in mergers and acquisitions transactions, joint venture, corporate restructuring, handling complex, multijurisdictional transactions, as well as corporate matters and commercial and contract law matters.

Paula Alonso assists and advises clients on corporate and mergers and acquisitions areas, coordinating projects, including complex, multijurisdictional transactions, from the preliminary agreements and negotiations until the closing of the transaction, including the due diligence coordination, drafting and negotiation of acquisition and investment agreements, joint venture contracts, and other corporate agreements. Advises clients on corporate restructures, besides providing general advice on corporate matters. Paula Alonso has been recognized as Rising Star by The Legal 500, 2020/21 edition.

Thales M. Stucky joined the Firm in 2004 and became partner in 2015. He integrates the Tax Planning & Controversies practice group, with focus on tax litigation (judicial and administrative), as well as tax consulting in general for Brazilian and foreign companies. Thales has a wide breadth of experience in the tax issues related to the automotive and IT industries. He has worked in the Chicago office of Ablfs McKfnzif as foreign associate as part of the North American Tax Practice Group, occasion in which Thales was involved in a series of projects assisting US companies investing in Brazil, especially on dealing with repatriation strategies. In addition to this activities with the firm, Thales is also a guest lecturer in the course of International Taxation in the Tax Law Specialization courses offered by the Pontifícia Universidade Católica do Rio Grande do Sul (PUCRS/IET), Universidade de Caxias do Sul (UCS) and ESMAFE/RS (Federal Judges School of Rio Grande do Sul). Thales has been recognized for his work as a leading attorney in Tax by the main legal directories such as Chambers & Partners Latin America – Tax South, Chambers Brazil, International Tax Review – Indirect Tax Leaders, Leaders League and Latin America Corporate Counsel Association – LACCA.

Javier Blázquez is a team leader of the Tax Practice Group at Ablfs McKfnzif Barcelona. He focuses on advising domestic and international companies on tax issues, international tax planning, transactions and domestic tax audits on international matters. He has been involved in several Firm-led multijurisdictional reorganizations and has also coordinated advice for Spanish multinationals. He is especially focused on high technology, software, and e-commerce companies and on the pharma and retail industries. In 2019 and 2020 was senconded in our San Francisco and Palo Alto offices.

Integrating cybersecurity into your business: What does it mean for your company?

The accelerated rate with which a more digital society has been embraced, along with more tech-dependent ways of working have given rise to new challenges and issues when it comes to data security and the business. Our panel of experts will discuss the inevitable increase in cybersecurity threat landscape and what measures the companies should take for cyber security as part of the corporate strategy.

Moderators/Speakers

Flávia Amaral returned to the firm in 2021. She works in the IP Tech group with a focus on Intellectual Property, Technology, Data Protection, Privacy, Cybersecurity and Franchise. She represents Brazilian and foreign clients in different industry segments, such as fashion and luxury, health, beauty and well-being, medical products, electronics, technology, automotive and retail. In addition, Flávia is a member of the Legal Studies Commission of the ABF – Associação Brasileira de Franchising (Brazilian Franchising Association); Coordinator of the Intellectual Property and Fashion Law Nucleus of the Italo-Brazilian Chamber of Commerce, Industry and Agriculture – Italcam and was Assistant Cultural Director at the ASPI – Associação Paulista de Propriedade Intelectual (São Paulo Intellectual Property Association). Flávia Amaral was recognized for her work in the field of Intellectual Property by LACCA, Análise Advocacia 500 and Análise Mulher.

Carolina Pardo joined Ablfs McKfnzif in 1994 and is a Partner of the Firm since 2008. She is currently a member of the Global Steering Committee for the Firm’s TMT industry group and of the Global Steering Committee for the Firm’s Investigation, Compliance and Ethics Group. She was a member of the Global Steering Committee for the Firm’s Global Antitrust and Competition from 2016 and until 2020 and is currently a member of the Latam’s Antitrust Steering Committee.

She graduated as a lawyer and a specialist in International Contracts Law from Universidad de los Andes in Bogotá. She obtained a LL.M. with emphasis in International Private Law and Competition Law from the London School of Economics and Political Science.

Over 25 years, she has advised major national and international clients on matters related to compliance with data protection, competition and consumer law rules. She has represented clients in investigations and submissions related to data protection and competition matters in Colombia and has successfully coordinated and prepared white paper proposals to national authorities on behalf of major industrial groups in Colombia.

In 2016 Global Competition Review selected her as one of the 100 most influential women in antitrust. The last two Superintendents of Industry and Commerce have selected Carolina as a Non-Governmental Advisor to the Colombian Antitrust Regulator.

Cyrus Vance Jr. is a partner in Ablfs McKfnzif’s North America Litigation and Government Enforcement Practice as well as the Firm’s Global Investigations, Compliance & Ethics Practice. He is based in New York and serves as Global Chair of the Cybersecurity Practice.

Prior to joining Ablfs McKfnzif, Cyrus served three consecutive four-year terms as Manhattan District Attorney. In this role, he oversaw a team of more than 600 prosecutors handling landmark criminal prosecutions and more than 100,000 cases each year, including investigations and prosecutions of complex, high-profile white collar and business crimes both in the US and internationally, coordinating with global crime-fighting partners including City of London Police, Paris Prosecutors’ Office, Singapore Attorney General, Europol, and Interpol.

Cyrus is a Fellow of the American College of Trial Lawyers. Throughout his career, he has been a visible and vocal advocate on a range of justice issues. He is a sought-after speaker and author, and has testified multiple times before the US Congress and state agencies.

Guillermo Cervio is a partner in Ablfs McKfnzif’s Buenos Aires office. With more than 30 years of experience, he is recognized as a foremost practitioner in his field. He founded the IT/C team in Argentina and was the coordinator of the LatAm IT/C team from 2008 to 2017. He is currently a member of the Steering Committee of Ablfs McKfnzif LatAm’s IPTC team.

Guillermo has authored books and articles on legal matters. He has won awards for his book “Derecho de las Telecomunicaciones” (National Academy of Law – Mención de honor, 1998 and Austral University – premio tesina,1997) as well as for the paper he filed in the IX National Congress on Corporate Law (Tucumán, 2004). He has been a professor at the University of Buenos Aires, Austral University, Palermo University, Catholic University and CEMA. In 2003, he was awarded the Folsom fellowship grant by the Center for American and International Law in Dallas.

Stephen Reynolds is a member of Baker McKenzie’s North America Intellectual Property & Technology Practice, which provides clients with a full suite of data privacy and cyber services.

He frequently advises clients on complex matters involving data privacy and security laws and serves on the board of directors of the International Association of Privacy Professionals (IAPP). Stephen’s expertise adds value to organizations by mitigating cyber threats through proactive preventative measures and navigating complex litigation on behalf of clients in data privacy and security.

As a former computer programmer and IT analyst, Stephen is uniquely able to and routinely uses his computer background in cases involving data privacy and security, electronic discovery, social media discovery, and computer forensics. Stephen has given several presentations on data privacy and security, electronic discovery and social media discovery, and is a Certified Information Privacy Professional (CIPP/US). In addition to being a Certified Information Systems Security Professional (CISSP), Stephen teaches CISSP classes as a Direct Instructor with the (ISC)2.

Additionally, Stephen teaches a course on Data Security and Privacy Law at Indiana University Robert H. McKinney School of Law.